Use of GST Calculator for Business

Introduction to GST Calculator

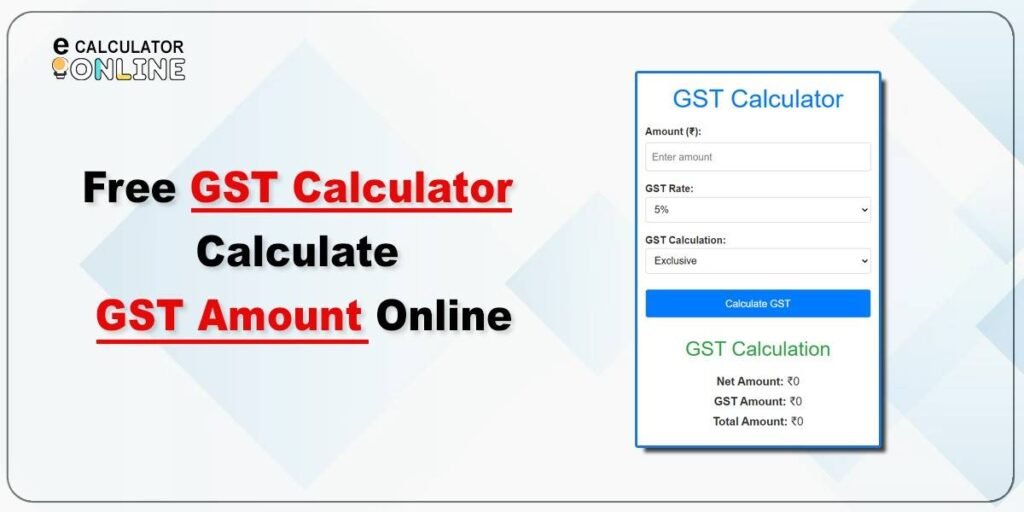

A GST Calculator is a simple and efficient tool designed to help users easily calculate the Goods and Services Tax (GST) on goods and services in India. As a part of the Indian tax system, GST simplifies indirect taxation by combining multiple taxes into one unified system. By using a GST calculator online, individuals and businesses can quickly determine the tax amount applicable to their transactions, ensuring transparency and accuracy. Whether you’re a business owner, freelancer, or consumer, an Indian GST calculator provides instant results and helps you better understand your tax obligations.

Types of GST Calculators

There are a variety of GST calculators available online, each tailored to meet specific needs:

Basic GST Calculator: This allows users to enter the transaction amount and GST rate to calculate the tax and total amount. It’s simple and quick to use, perfect for consumers and small businesses.

Comprehensive GST Calculator: This type provides options to calculate GST both inclusively and exclusively. You can calculate the pre-tax and post-tax amounts, making it useful for detailed financial planning.

Reverse GST Calculator: This calculator is used to determine the base price when the GST-inclusive price is known. It’s particularly helpful for businesses that need to work backward from the total cost.

Industry-Specific GST Calculator: These are specialized calculators designed for particular sectors, like e-commerce, manufacturing, or real estate, helping businesses calculate GST based on specific industry rules.

Each type of GST calculator online caters to different user requirements, making it easier to calculate GST online for various transactions.

Why Use a GST Calculator

Using an online GST calculator is essential for several reasons:

Accuracy: Manual calculations can lead to errors, but with a GST calculator, you get instant and accurate results every time.

Time-Saving: Calculating GST manually takes time. With a GST calculator in India, you can calculate tax amounts in seconds, saving valuable time.

Transparency: Whether you are buying a product or offering services, knowing how GST is applied helps ensure fair transactions.

Simplified Tax Planning: A GST calculator online allows you to plan your taxes effectively by showing the precise amount of GST applicable.

Understanding how GST is calculated has never been easier, and a GST calculator provides you with the clarity and simplicity you need in your transactions.

Features of the Online GST Calculator

The online GST calculator comes with numerous features that make it a must-have tool for individuals and businesses:

User-Friendly Interface: Most Indian GST calculators are easy to use. All you need to do is enter the required details like the taxable amount and GST rate.

Real-Time Calculations: You can get immediate results based on current GST rates, eliminating the need for manual calculations.

Customizable Tax Rates: An online GST calculator allows you to choose from a variety of GST rates such as 5%, 12%, 18%, and 28%, based on your transaction.

Inclusive and Exclusive Calculation: With just a click, you can calculate GST for both inclusive and exclusive prices, providing flexibility depending on the type of transaction.

Device Compatibility: Most GST calculators online are optimized for both desktop and mobile, allowing you to calculate GST online from anywhere.

These features make the GST calculator online an essential tool for anyone looking to easily and accurately calculate GST.

Benefits of Using an Online GST Calculator

There are several advantages of using an Indian GST calculator:

Instant Results: You can calculate GST online in just a few seconds, helping you manage your finances more effectively.

Reduces Errors: Manual errors in GST calculation can lead to costly mistakes. An online GST calculator eliminates this risk by providing accurate results.

Cost-Effective: Most GST calculators online are free to use, saving you the hassle of hiring financial professionals for simple GST calculations.

Improves Financial Planning: By knowing exactly how much GST is payable or receivable, businesses and individuals can plan their expenses or earnings more effectively.

Better Understanding of Tax Structure: Using a GST calculator helps you gain a clearer understanding of how to calculate GST and how it impacts pricing, which is beneficial for consumers and business owners alike.

By incorporating these benefits, a GST calculator in India simplifies tax management, saving you time, effort, and money.

Categories

Latest Posts

- Fixed vs. Floating Interest Rates: What Your EMI Calculator Won’t Tell You

- Top 10 Root Calculator Tools to Simplify Your Math Problems

- BMR Chart Breakdown: Tailor Your Caloric Intake and Fitness to Your Metabolism

- Does Increasing Muscle Mass Really Boost Your BMR?

- Why the BMR Chart is a Game-Changer in Weight Loss and Fitness

- Top 10 Reasons Why You Need a BMR Chart for Your Health Goals

Frequently Asked Question

A GST Calculator is an online tool used to calculate the Goods and Services Tax on a given amount. It helps in determining the GST amount, whether it is inclusive or exclusive of the total amount.

Simply enter the amount and select the GST rate applicable. The calculator will provide you with the GST amount and the total amount inclusive of GST.

Yes, many GST Calculators can handle various GST rates, making them suitable for businesses with different tax brackets.

Yes, a well-designed GST Calculator is accurate and reliable, provided that the correct rate and amount are entered.

Most online GST Calculators are free to use, offering a cost-effective way to manage your GST calculations.