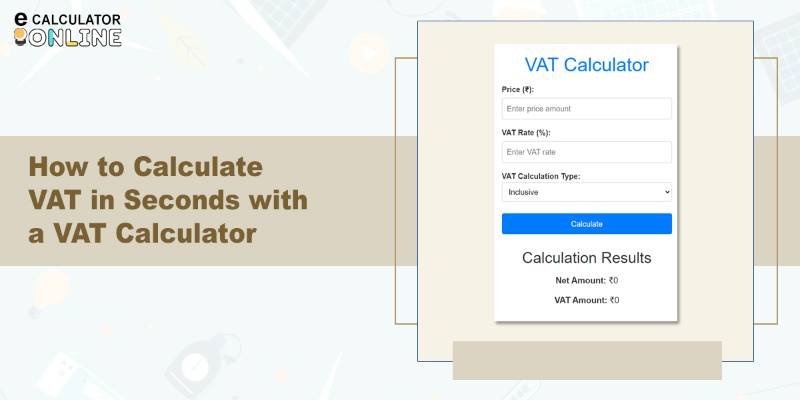

How to Calculate VAT in Seconds with a VAT Calculator

Introduction to VAT Calculator

Value Added Tax (VAT) can be a bit overwhelming, especially when you’re dealing with multiple transactions. A calculator for VAT is an essential tool that simplifies this process by allowing you to calculate VAT amounts quickly and accurately. Whether you’re a business owner, accountant, or just someone trying to understand how much VAT you need to pay or charge, using a VAT calculator ensures you get the correct figures without any hassle. This tool takes the guesswork out of tax calculations, making it easier to handle your finances.

Types of VAT Calculator

There are different types of VAT calculators available, each designed to meet specific needs:

Basic VAT Tax Calculator: This simple calculator allows you to enter the amount and VAT rate to quickly calculate VAT on your transactions. It’s perfect for those who need quick results without any added complexity.

Advanced VAT Calculator: This type of calculator offers additional features such as multiple VAT rate options, inclusive and exclusive VAT calculations, and even the ability to calculate VAT for different regions or countries. It’s ideal for businesses handling more complex transactions.

Online VAT Calculator: The VAT online calculator is accessible from any device with internet access. These calculators often provide real-time VAT rate updates, ensuring you’re always using the most current data.

Mobile VAT Calculator Apps: Perfect for those on the go, mobile VAT calculator apps provide all the functionality of an online VAT calculator but in a convenient app format that you can use anywhere.

Each of these calculators serves a unique purpose, ensuring there’s a calculator for VAT for every situation.

Why Use a VAT Calculator

There are several reasons why you should consider using a VAT calculator:

Accuracy: Calculating VAT manually can lead to errors, especially when dealing with multiple transactions. A VAT calculator ensures accuracy, helping you avoid costly mistakes.

Time-Saving: Using a calculator means you can calculate VAT in just a few seconds, freeing up more time for other important tasks.

Convenience: With an online VAT calculator, you can calculate VAT amounts from anywhere, anytime, without needing to do complex math.

Consistency: A VAT tax calculator ensures consistent calculations, making it easier to keep track of your finances and ensuring you’re always compliant with VAT regulations.

Using a VAT calculator is an excellent way to stay on top of your VAT calculations without the stress of manual computations.

Features of the Online VAT Calculator

An online calculator VAT comes with various features that make it an indispensable tool for handling VAT calculations:

Real-Time VAT Rates: The calculator uses up-to-date VAT rates, ensuring you always work with the correct data when you calculate VAT.

Inclusive and Exclusive VAT Calculation: You can calculate both the VAT-inclusive and VAT-exclusive amounts, providing flexibility based on your needs.

User-Friendly Interface: Most online VAT calculators are designed to be easy to use, even for those who aren’t experts in finance.

Customizable Rates: Many calculators allow you to input different VAT rates, which is especially useful for businesses operating in multiple regions with varying VAT percentages.

Accessible Anywhere: Whether you’re using a desktop, laptop, tablet, or smartphone, the VAT online calculator is available at your fingertips whenever you need it.

These features make an online VAT calculator an efficient and reliable tool for handling VAT calculations, no matter how simple or complex.

Benefits of Using an Online VAT Calculator

Using an online calculator VAT offers numerous benefits, including:

Simplicity: You don’t need to be a math expert or have in-depth knowledge of VAT laws to use the calculator. It simplifies the process, making it accessible to everyone.

Time Efficiency: With just a few clicks, you can calculate VAT accurately, saving you time compared to manual calculations.

Cost Savings: Many VAT tax calculators are free to use, providing you with a cost-effective way to handle your VAT calculations.

Minimizes Errors: By using an online VAT calculator, you significantly reduce the chances of making mistakes, which can be costly in the long run.

Better Financial Management: An accurate calculator for VAT helps you manage your finances better by providing precise figures, ensuring you remain compliant with tax regulations.

By leveraging a VAT VAT calculator, you simplify your financial processes, ensuring accuracy and efficiency in all your VAT-related transactions.

Categories

Latest Posts

- Fixed vs. Floating Interest Rates: What Your EMI Calculator Won’t Tell You

- Top 10 Root Calculator Tools to Simplify Your Math Problems

- BMR Chart Breakdown: Tailor Your Caloric Intake and Fitness to Your Metabolism

- Does Increasing Muscle Mass Really Boost Your BMR?

- Why the BMR Chart is a Game-Changer in Weight Loss and Fitness

- Top 10 Reasons Why You Need a BMR Chart for Your Health Goals

A VAT Calculator is an online tool that helps you calculate the Value Added Tax on a given net amount, providing both the VAT amount and the total inclusive amount.

To use a VAT Calculator, simply input the net amount and select the applicable VAT rate. The calculator will then display the VAT amount and total amount.

Yes, a well-designed VAT Calculator provides accurate calculations, minimizing the risk of human error.

Many VAT Calculators offer options to input multiple rates, allowing you to perform calculations for various products or services with differing VAT rates.

Most Online VAT Calculators are free to use, making them a cost-effective option for managing your VAT calculations.