Inclusive vs. Exclusive GST: How to Calculate Both Using a GST Calculator

Goods and Services Tax (GST) can be quite confusing, especially when it comes to understanding the difference between inclusive and exclusive GST. Fortunately, using a GST calculator makes this process a lot simpler, helping you perform accurate calculations quickly and effortlessly. This blog will break down the differences between inclusive and exclusive GST, and explain how to calculate GST online using a GST calculator in India.

Understanding Inclusive vs. Exclusive GST

Before diving into how to use a GST calculator online, it’s essential to understand the terms “inclusive” and “exclusive” GST:

Inclusive GST: When the GST amount is already included in the total price, it means you are paying for the product or service with the tax bundled in. For instance, if you see a price tag of ₹500 (inclusive of GST), the tax is part of that amount.

Exclusive GST: In this case, the GST is added to the base price of the product or service. For example, if a product costs ₹500 (exclusive of GST) and the GST rate is 18%, the final price will be ₹590.

Understanding these differences is crucial for accurate calculations, and this is where a GST calculator comes in handy.

How to Calculate GST Using a GST Calculator

Calculating GST manually can be time-consuming, but an Indian GST calculator simplifies this task. Here’s a step-by-step guide on how to calculate GST online:

For Inclusive GST Calculation:

- Enter the total amount, which includes GST.

- Choose the applicable GST rate (e.g., 5%, 12%, 18%, or 28%).

- The GST calculator will display the original price before tax and the GST amount.

For Exclusive GST Calculation:

- Enter the base price of the product or service.

- Select the GST rate.

- The GST calculator online will add the GST amount to the base price, showing you the final price to be paid.

This user-friendly approach allows you to see how GST services impact the overall cost, whether you’re a business owner or a consumer.

Benefits of Using a GST Calculator Online

An Indian GST calculator offers several advantages:

- Accuracy: Manual calculations can lead to errors. A GST calculator ensures precise results every time.

- Time-saving: No need to spend time working out complicated formulas; simply enter your values, and you’ll have the answer in seconds.

- Flexibility: You can calculate both inclusive and exclusive GST amounts with ease, making it ideal for various GST services.

Whether you’re a business or an individual looking to calculate GST online, this tool simplifies the entire process.

How GST is Calculated: Understanding the Formula

Knowing how GST is calculated manually can enhance your understanding of how a GST calculator works. Here’s the formula used:

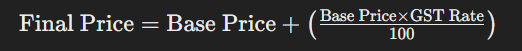

For Exclusive GST:

For Inclusive GST:

By inputting these values into an Indian GST calculator, you can bypass these complex calculations and get results instantly.

Why You Should Use a GST Calculator in India

If you’re wondering why you should use a GST calculator in India, here are a few reasons:

- Simplicity: An online calculator simplifies the process, ensuring that anyone can calculate GST without a financial background.

- Consistency: Regularly using a GST calculator online ensures that your calculations are consistent, which is particularly beneficial for businesses managing their taxes.

- Real-Time Calculations: With updated rates, you can calculate GST accurately as per the latest rules.

These reasons highlight the importance of using an online calculator for any transactions involving GST services.

Categories

Latest Posts

- The Evolution of GST Calculators: From Manual to Online Tools

- 10 Mistakes to Avoid While Using an EMI Calculator

- Top Benefits of Using an Online EMI Calculator for Financial Planning

- 5 Common Mistakes to Avoid When Using an EMI Calculator

- How to Use an EMI Calculator to Plan Prepayments and Reduce Your Loan Tenure

- The Future of EMI Calculators: AI-Powered Features to Expect in Fintech Tools

FAQs on How to Calculate GST Online

Simply enter the base price or total amount and choose the applicable GST rate. The GST calculator online will show the inclusive or exclusive amount based on your selection.

An Indian GST calculator ensures you get accurate results in seconds, saving you from the hassle of manual calculations.

While it’s not mandatory to know the detailed calculation, understanding the process helps you make better financial decisions and ensures you’re not overpaying on GST.