Mortgage Calculator

Mortgage calculator – Calculate Repayments

Introduction to Mortgage Calculator

Are you planning to buy a new home or refinance your existing mortgage? Understanding your monthly payments is crucial before making any financial commitments. This is where a home loan interest calculator or a mortgage repayment calculator can be incredibly helpful. A mortgage calculator is an online tool designed to help you estimate your monthly mortgage payments, including principal and interest, taxes, and insurance. By using an emi calculator for mortgage loan, you can get a clear picture of how much you’ll be paying over the life of your mortgage, making it easier to manage your finances and plan for the future.

Key Elements of a Mortgage Calculator

A comprehensive home calculator incorporates various key elements to provide accurate results:

Loan Amount: This is the total amount you borrow for your home. The calculator requires you to input this figure, as it’s the foundation for determining your monthly payments.

Interest Rate: The interest rate significantly impacts your mortgage repayments. Using a home loan interest calculator, you can input the interest rate you’ve been offered to see how it affects your monthly payments.

Loan Tenure: This refers to the length of time over which you’ll repay your mortgage. Most mortgages range from 10 to 30 years. The mortgage principal and interest calculator takes this into account to provide an accurate monthly payment estimate.

Down Payment: The down payment is the amount you pay upfront when purchasing your home. By entering this amount into the mortgage repayment calculator, you’ll see how it reduces your total loan amount and monthly payments.

Property Taxes and Insurance: A comprehensive home calculator also factors in property taxes and homeowner’s insurance, giving you a complete understanding of your overall monthly obligations.

How the Mortgage Calculator Works

Using a mortgage principal and interest calculator is simple and straightforward. Here’s how it works:

Input Your Details: Start by entering the essential information, such as the loan amount, interest rate, loan tenure, and down payment. The more accurate the information you provide, the more precise your calculation will be.

Calculate the EMI: Once you’ve entered all the required data, the emi calculator for mortgage loan will instantly calculate your monthly payments. It considers the interest rate, loan tenure, and principal amount to determine your equated monthly installment (EMI).

Analyze the Results: The mortgage repayment calculator will display your monthly payment, total interest payable, and the total repayment amount over the loan period. This detailed breakdown helps you understand how much you’ll be spending each month and over the entire loan duration.

By using this home loan interest calculator, you can adjust the loan amount, interest rate, or loan tenure to see how different variables impact your monthly repayments, allowing you to make informed decisions.

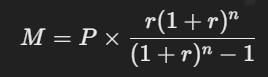

Mortgage Payment Formula:

The calculation for monthly mortgage payments is based on the following formula:

Where:

- M = Monthly payment

- P = Loan amount (principal)

- r = Monthly interest rates.

Benefits of Using a Mortgage Calculator

Using a mortgage repayment calculator offers several advantages:

Financial Planning: With a clear view of your monthly mortgage payments, you can plan your finances better. The home calculator helps you understand how much you can afford, preventing you from overextending yourself.

Time-Saving: Instead of manually crunching numbers, the emi calculator for mortgage loan provides instant results, saving you time and effort.

Comparison Tool: If you’re considering multiple loan options, the mortgage principal and interest calculator allows you to compare different interest rates and loan tenures to find the most affordable option.

Accurate Estimations: By using a home loan interest calculator, you get accurate estimations, which is essential for budgeting and avoiding surprises down the road.

Better Negotiation Power: When you know your exact monthly payments, you’re in a better position to negotiate loan terms with lenders, helping you secure a deal that fits your budget.