VAT Calculator

Calculation Results

Net Amount: ₹0

VAT Amount: ₹0

Free Vat Calculator - Find Vat on Inclusive or Exclusive

Introduction to VAT Calculator

Understanding Value Added Tax (VAT) can be tricky, especially when trying to figure out whether it’s inclusive or exclusive of your product’s price. This is where a VAT Calculator becomes incredibly useful. A VAT calculator for VAT is a simple yet powerful tool designed to help individuals and businesses quickly determine the exact VAT amount on a product or service. Whether you’re running a business or just shopping, using a VAT VAT calculator ensures you know precisely how much VAT you’re paying or need to charge. It’s a must-have tool for anyone looking to handle their finances effectively, be it for VAT tax calculation or general budgeting.

Key Functions of a VAT Calculator

A VAT tax calculator comes with several key functions that make it an invaluable tool for users:

Inclusive VAT Calculation: This function allows you to calculate VAT included in the total price. Simply enter the total amount, and the calculator for VAT will break down how much VAT is part of that amount.

Exclusive VAT Calculation: If you want to add VAT to a net price, the VAT calculator will compute the total amount, including the added tax. This is particularly useful for businesses that need to add VAT to their prices.

Real-Time Calculation: With an online VAT calculator, you get instant results, making it easy to make quick financial decisions without any hassle.

Multiple VAT Rates: The VAT rates can differ by country or region, and a good online calculator VAT allows you to choose different VAT percentages, giving you the flexibility to calculate VAT accurately no matter where you are.

These functions make a VAT calculator a versatile and essential tool, whether you’re looking to calculate VAT for a single item or an entire shopping cart.

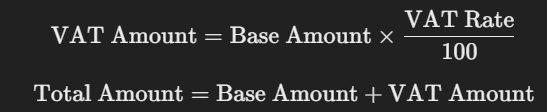

How VAT Calculations Work with Formula

Understanding how to calculate VAT manually can help you appreciate the value of using a VAT online calculator. Here’s a breakdown of how VAT calculations work:

1. For VAT Inclusive: If the price already includes VAT, you can use this formula to find the VAT amount:

2. For VAT Exclusive: If you want to add VAT to a net amount, the formula is:

Benefits of Using a VAT Calculator

There are numerous benefits to using an online calculator VAT:

Accuracy: A VAT calculator eliminates human error, ensuring that your calculations are always correct. This is crucial for businesses that need to calculate VAT accurately for tax purposes.

Time-Saving: Calculating VAT manually can be time-consuming, especially when dealing with multiple transactions. With a VAT tax calculator, you can calculate VAT in seconds, saving valuable time.

Easy to Use: You don’t need any prior knowledge of VAT calculations to use an online VAT calculator. It’s user-friendly and designed for anyone, whether you’re a business owner, accountant, or shopper.

Convenience: An online VAT calculator can be accessed anytime and anywhere, making it perfect for on-the-go calculations. It’s especially handy when shopping online or preparing invoices.

Flexibility: With options to calculate VAT inclusively or exclusively, the calculator for VAT adapts to your needs, ensuring you always have the correct figures.

By using a VAT calculator, you not only save time and effort but also gain confidence in knowing your VAT calculations are accurate, allowing you to focus on what truly matters.